Bill DeBlasio is suing oil companies for creating bad weather. Ross McKitrick points out what are no doubt only a few of the lies and BS in the filing.

Category Archives: Mathematics

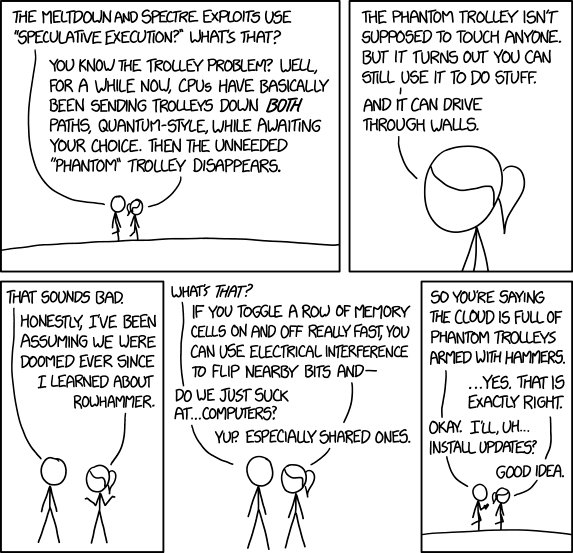

The Intel Bug

This seems like a pretty major eff up. I’m running AMD, except for the new HP two in one I bought a couple weeks ago.

[Update a while later]

Linus Torvalds giving Intel both barrels over its CPU bug PR spin ??? https://t.co/f9MbPQhgz8 pic.twitter.com/Go02sQUN62

— The Register (@TheRegister) January 4, 2018

[Friday-morning update]

The Budget “Reform” Act

Now that they’ve started to tackle taxes, it’s time for the Republicans to fix this as well:

As any student of political behavior might have predicted, both parties have learned to game these systems. Obamacare and the tax bill provide many examples.

Democrats got the CBO to count the revenue generated by Obamacare’s Community Living Assistance Services and Supports, or CLASS, Act taxes, fully aware that program’s postponed and unsustainable costs would never be incurred. Republicans likewise took some $300 billion of savings, suddenly available when CBO revised its clearly mistaken estimates of costs of repealing Obamacare’s individual mandate, to pay for tax cuts it couldn’t otherwise get.

This is not a criticism of CBO, which has remained properly nonpartisan and which was designed to estimate revenue flows, not personal choices — such as how many young people would rather pay small individual mandate penalties rather than expensive Obamacare health insurance premiums.

It’s a criticism of the notion that you can create neutral rules that will guide elected politicians to desired results. Politicians and the voters they represent have policy goals they believe important and they have their own ways — fallible, but subject to criticism and debate — to estimate the likely effects of particular policies.

My observation over the years is that systems intended to be failsafe are sure to fail. Forty years of the Budget Control Act regime and 30 years of the opaque Byrd Rule (which allows some Senate measures to pass with 50 votes while others require 60) have shown that both parties have figured out how to game the rules enough to foil those the intended purposes.

The notion that anyone, let alone the CBO, can with any accuracy predict the effects of changes in tax rates and other incentives over a decade is absurd.

Bi-Lingual People

This is interesting, if true; their brains solve math problems differently.

Traffic Jams

Smart cars have the potential to solve them.

Another thing they’ll do is to all start moving when the light changes, so we won’t wait until the car in front of us moves.

The California Fires

Were they caused by climate change?

Ummmmmmm…no.

No, Jerry Brown, it's hilariously stupid to think, let alone say that December wildfires are "the new normal" in California based on a single year.

— Rand Simberg (@Rand_Simberg) December 12, 2017

Artemis

A description of Andy Weir’s lunar settlement.

Out Of Town

I was driving up to San Francisco yesterday, and today I’m at the Foresight Vision Weekend. There was a session on longevity (including cryonics) this morning, and now there’s a panel on blockchain and it’s potential applications. One of the panelists says that one app he’s woring is with a company that wants gas stations in space. I’ll have to talk to him later.

The Password Era

Will blockchains bring it to an end?

A Veneer Of Certainty

How dependable is climate science?

Not enough to base energy policy on.

[Update a few minutes later]

A vigorous fisking of what Judith Curry calls “the stupidest [peer-reviewed] paper ever written.” With all respect to Professor Curry, that’s a pretty high bar, even in this field.

[Update a couple minutes later]

OK, I slightly misquoted her.

This is absolutely the stupidest paper I have ever seen published https://t.co/jBSiJ1DMlL pic.twitter.com/XnuRZDrsUt

— Judith Curry (@curryja) November 29, 2017

[Update a while later]

Link is fixed, sorry!